Brian Almon has missed the policy mark – again.

In his latest column, Almon discusses the Idaho Republican Party’s initiative to repeal Idaho’s ornery grocery tax. Per usual, Almon dithers and refuses to take a hard stand one way or the other.

In the midst of his dithering, he leaves out a key piece of information that upends his whole argument.

Almon points out that, according to his own calculations, some poor families might actually see a tax hike under a repeal of both the credit and the tax.

Interesting, if true. But there’s more to the story — a piece of the puzzle Almon forgets — and it should concern middle-class families.

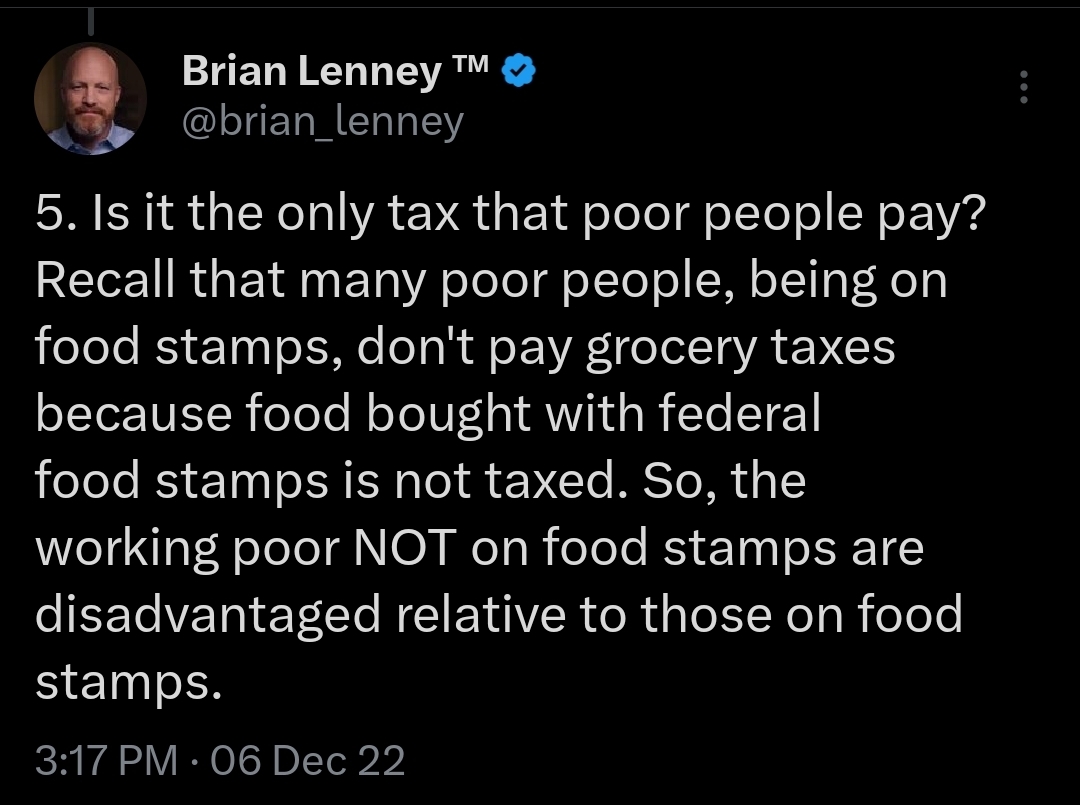

Many of Idaho’s low-income families do not pay the grocery tax. Former IFF President Wayne Hoffman pointed this out more than a decade ago in a column.

“Under Idaho’s very strange tax system, people who use government assistance are rewarded, and people who don’t are penalized,” Hoffman wrote. “The people on government assistance can buy more and spend more on groceries than everyone else.”

Did you catch that? Families on food stamps don’t pay for their own food — and they don’t pay the grocery tax.

Middle-class and affluent families are left holding the bag, as usual.

To be sure, some Idaho families would see a tax hike under repeal. But most families — including mine — would see modest tax relief.

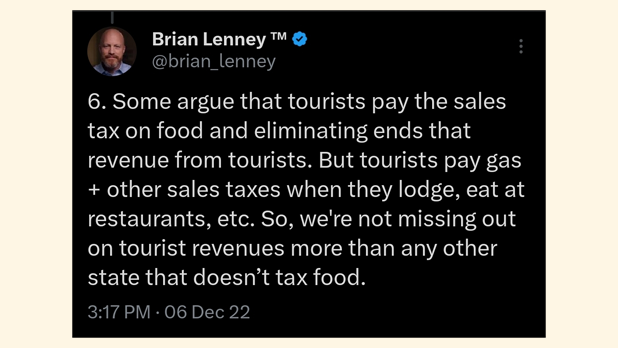

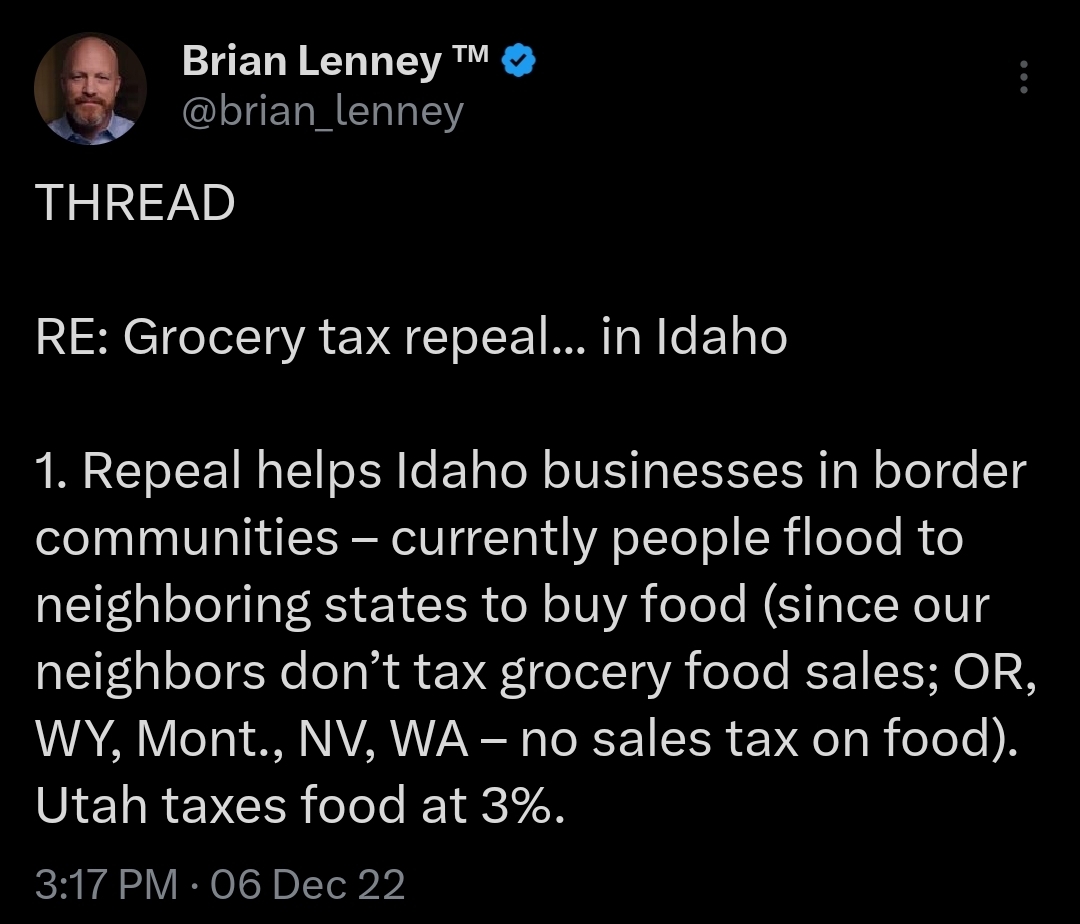

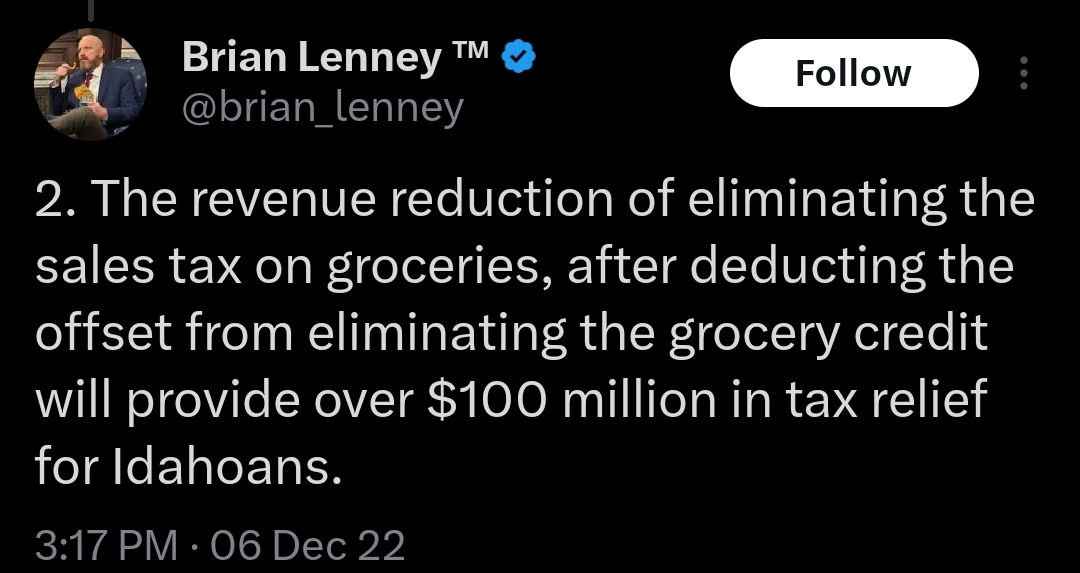

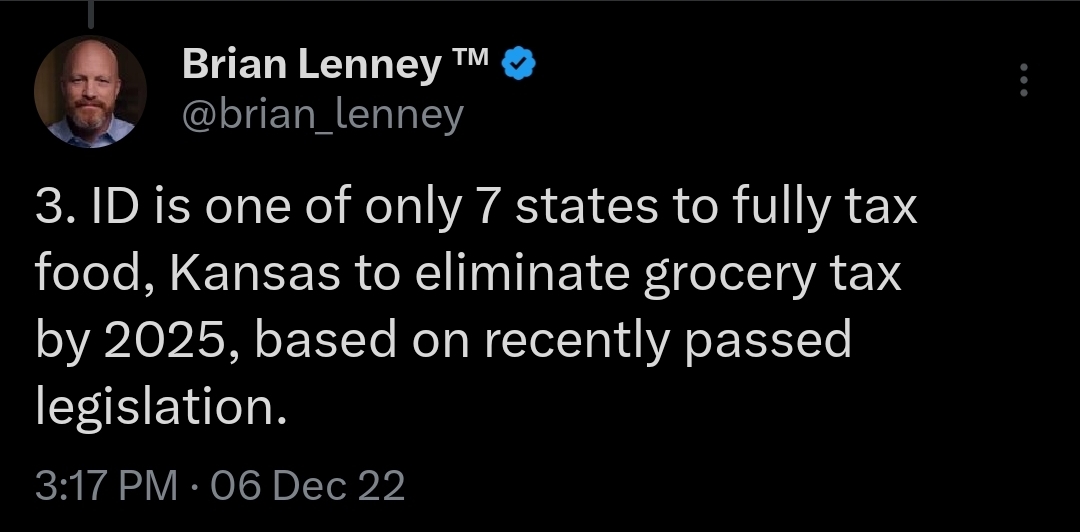

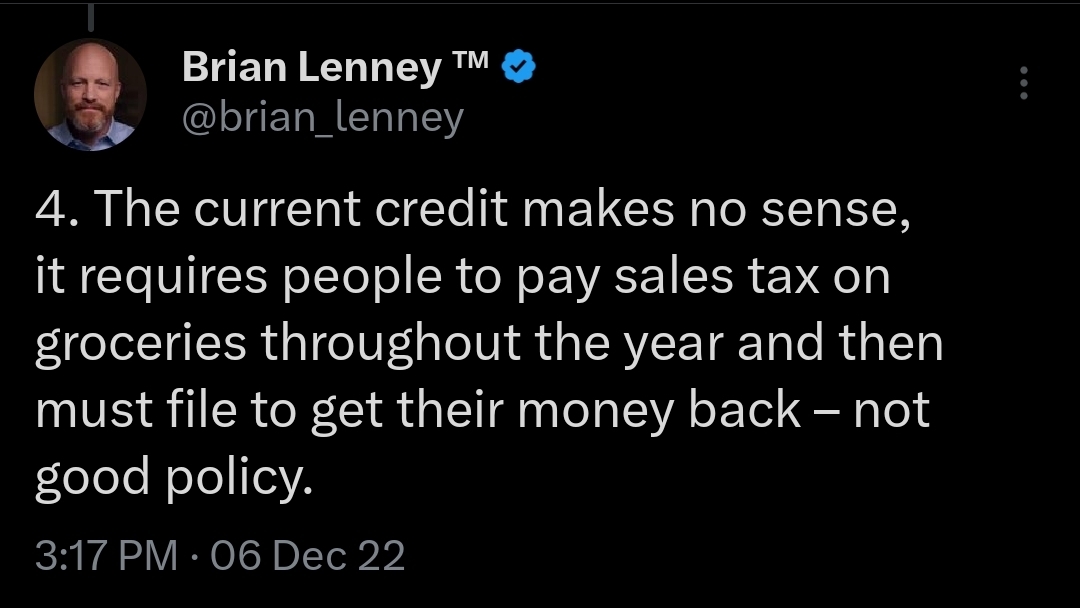

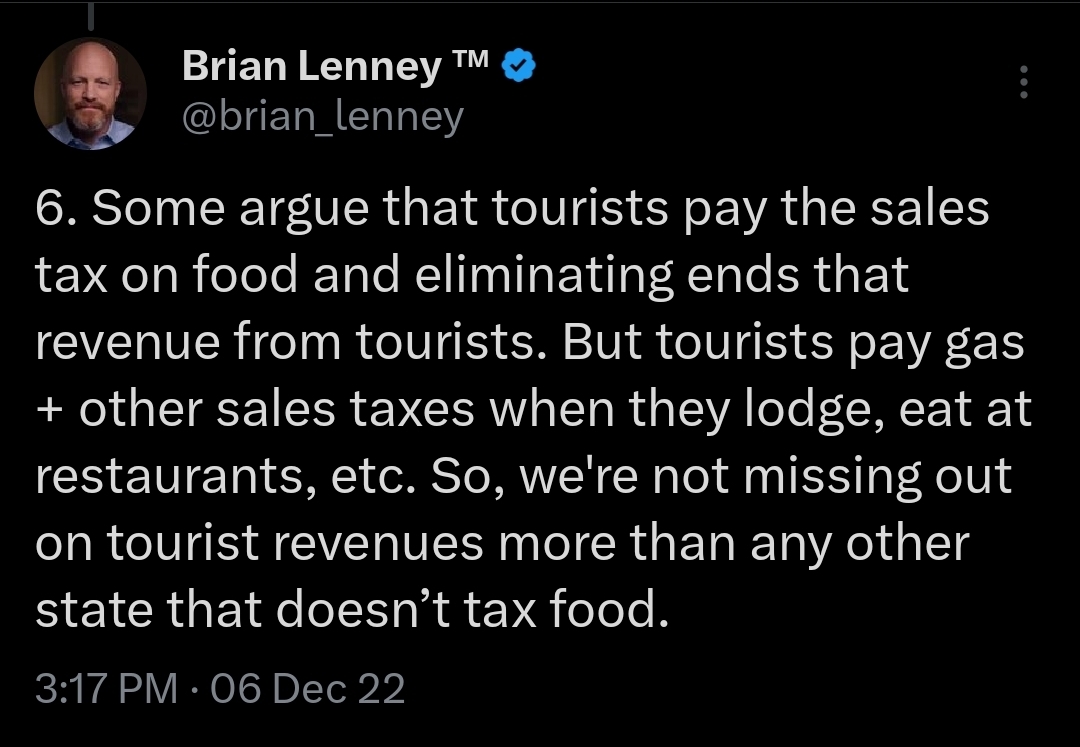

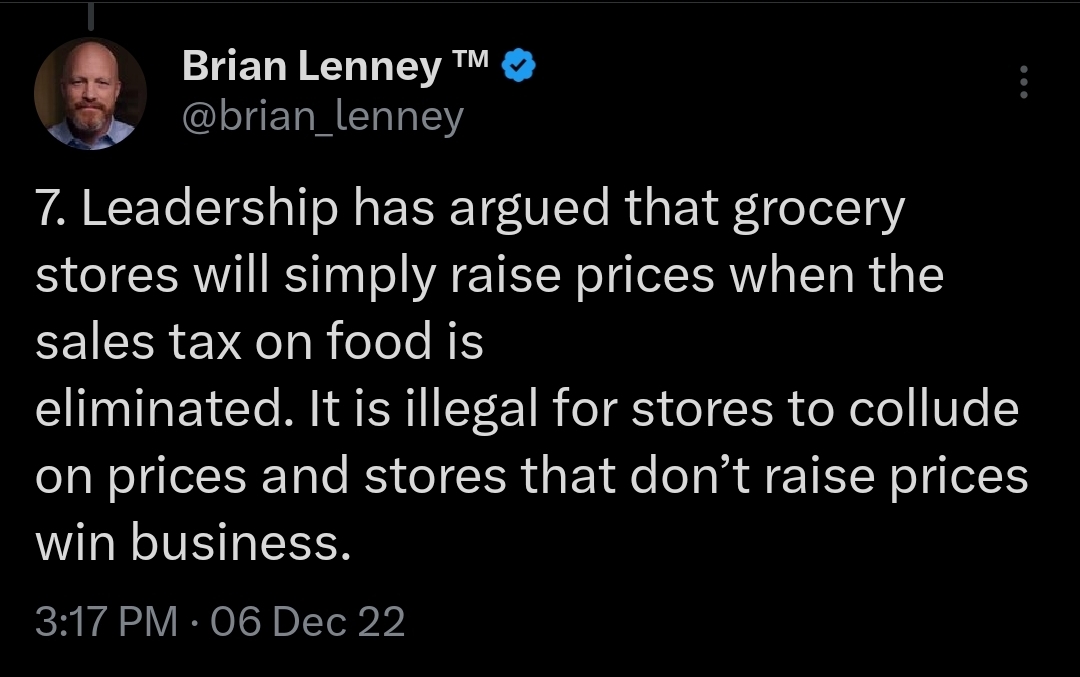

There are myriad good reasons to repeal the grocery tax. In fact, Nampa Sen. Brian Lenney made the case a few years back on X in a very thorough thread. Here are his many arguments for repeal:

That’s really good stuff.

And, as Lenney noted elsewhere, this is a good measure that nearly everyone can get behind.

Sometimes in public policy, pretend pundits like to overthink things. This one is really pretty simple.

Repeal the grocery tax and the credit. Only four states fully tax food, and Idaho is among them. Even the California commies have this one figured out.